The Full Story:

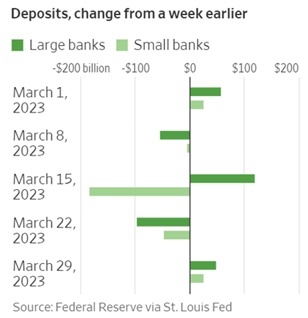

The Federal Reserve acted quickly and decisively to limit contagion after depositors fled Silicon Valley Bank and Signature Bank. While First Republic Bank and a few other lenders teetered on edge, the Fed’s liquidity programs provided enough stability to stop the panic. In fact, deposit trends have improved for small banks, as seen below:

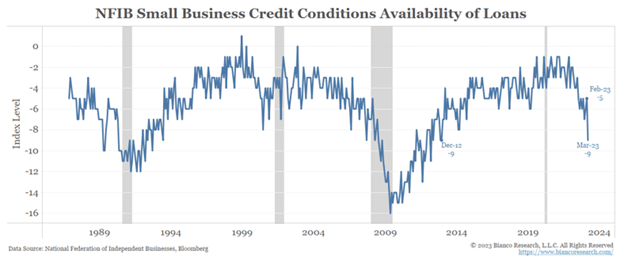

While the acute liquidity crisis may have passed, rattled bank boardrooms have become far more cautious. Credit conditions have tightened dramatically to levels only seen during prior recessions. Small businesses have reported the least access to credit dating back to the Great Financial Crisis per the most recent survey from the National Federation of Independent Businesses:

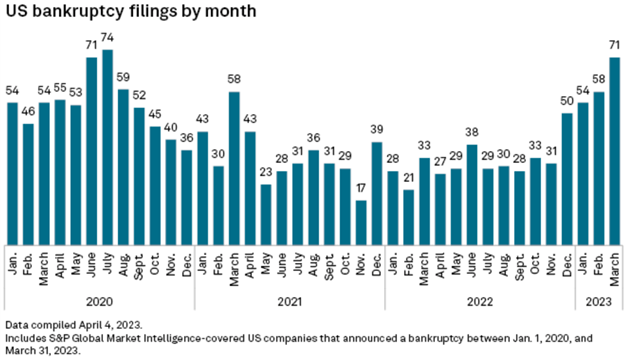

And as credit conditions tighten, economic conditions deteriorate like the withering of a fern without water. In fact, corporate bankruptcy filings for March in the United States have now reached levels last seen during the COVID quarantines:

In our credit-fueled economic system, reductions in credit extensions have consequences. But before you get too pessimistic, remember that this is precisely what the Fed wants! Jerome Powell first used the phrase “pain” to describe the Fed’s policy objective at his Jackson Hole speech six months ago. Since then, the Fed has increased overnight interest rates at a breakneck pace. The purpose of increasing interest rates swiftly was to force banks to limit lending swiftly.

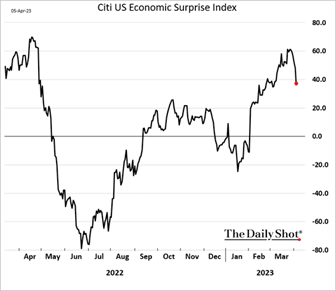

Simply put, banks pay depositors for money they then loan out at higher rates. Before rates increased, banks paid depositors 0% and loaned money to borrowers at 3-5%. Now banks have to pay depositors 5%, forcing them to lend money to borrowers at 8-10%. Borrowers might be willing and able to borrow lots of money at 3-4% in a booming economy, but they are far less willing and able to borrow lots of money at 8-10% in a soft economy. While Powell may have called for these conditions in August, banks received a 0% grace period from depositors now demanding much higher rates after the SVB revelation. In other words, what Powell called for in August of 2022, has now hit in March of 2023. For further evidence of the economic downshift, consider the rapid decline in the Citigroup Economic Surprise index. We have received a string of economic releases post-SVB, surprising to the downside. This includes the most recent consumer and producer price inflation releases as well:

This chain of events and data confirmation led Fed staffers to concede (more likely celebrate) that the US economy will enter recession this year. The severity and duration of which will now consume the debate.

Welcome to the Recession

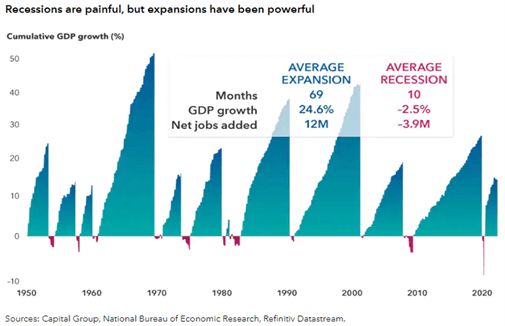

With the Fed determined to trigger an economic recession, its initiation provides perverse relief. Given that Powell has been browbeating us with mean-spirited forward guidance for over a year, investors and corporate executives have already been in a psychological recession. Investors sold stock markets down to their median 25% recessionary decline in 2022, and corporations have announced large-scale restructurings and layoffs in 2023. These events typically occur during recessions, not before! So, while GDP reports may not depict recession, marketplace activity reports do, as players prepare for the “pain” game. How much pain should we expect?

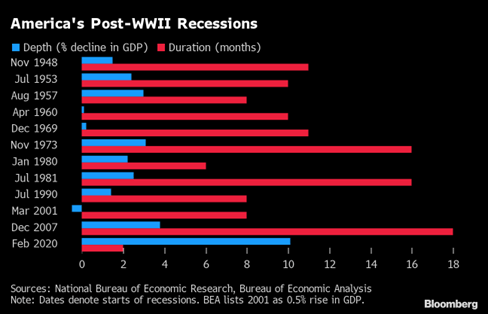

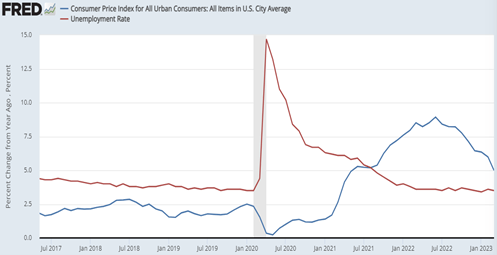

On average, in the post-war period, recessions last about three quarters, and GDP falls about 2.5%. Unemployment levels shoot higher as businesses reactively and rapidly shed costs. History doesn’t repeat, but it rhymes. Therefore, we should expect a 1-2ish percent GDP decline over a three-quarter period. However, given that businesses entered their psychological recession months ago at the Fed’s urging, they have had the ability to cut costs more methodically and strategically by firing excess real estate and administrative complexities in advance rather than firing staff in reaction. This should add ballast beneath the oncoming recession, leading to a disproportionate drop in inflation versus the rise in unemployment, as already seen in my favorite fog-cutting chart of the year:

Consumer Price Inflation fell from 9% in June 2022 to 5% in March 2023. Meanwhile, the unemployment rate fell from 3.6% in June 2022 to 3.5% in March 2023. For those Phillips Curve disciples who assert that inflation cannot reach the Fed’s 2% target level without a substantial rise in unemployment, the data and I doth protest. Inflation vacillated between 2% and 2.5% before the pandemic, while the unemployment rate fluctuated between 3.5% and 4% for years.

So, bring on the recession, Mr. Powell. Get it over with. We are prepared, we have been awaiting it, and we can endure it without mass layoffs and earnings collapses. In fact, markets are nearly a year ahead of you and already in recovery. Tighten again, if you like, for assurances, but you will be cutting before year-end. By that time, sentiment will have migrated from denial, anger, and acceptance toward confidence and optimism because what we know as investors and corporate leaders is that recessions are exceptions. Expansions are the rule.

Enjoy your Sunday!