The Full Story:

Friday’s strong jobs report paired against negative first quarter GDP and lame second quarter GDP estimates seems disjointed. Analysts expected the US economy to add 270,000 jobs in June. Instead, the economy added 372,000, well above estimates. 152 million Americans held a job in June, reclaiming levels hit just before the pandemic. Overall, the US unemployment rate remains historically low at 3.6%.

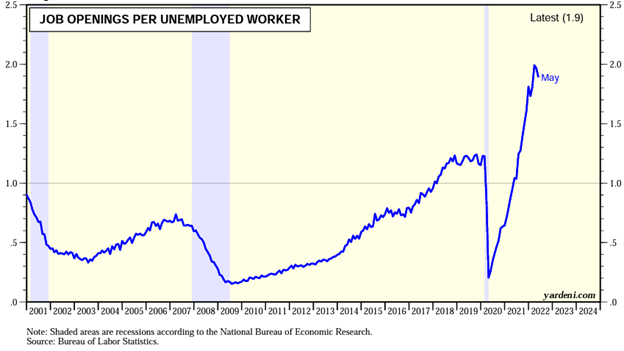

Unfortunately, the labor force participation rate (those capable of work that are working or looking for work) remains stubbornly low at 62.2%, down from 63.4% pre-pandemic. Let’s dig into this number a bit. In total, the US civilian population equals 333 million. Of the total population, the number of people eligible for work (over 16 years old) equals 264 million. Of those, 164 million count themselves as either working or looking for work. This means roughly 100 million US citizens over the age of 16 are not in the labor force. Of those, 50 million are retirees. This means the other 50 million Americans are eligible for work but not seeking work. We need them. According to the most recent job openings data, there are currently 1.9 open jobs for each person in the workforce seeking employment:

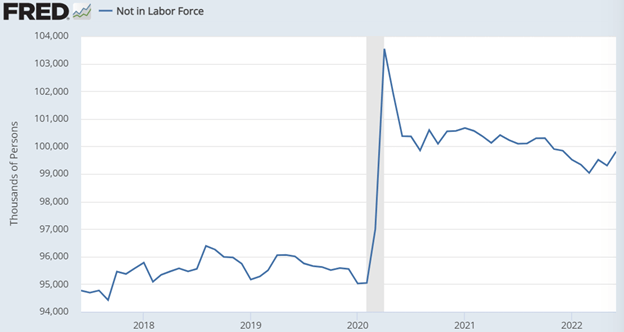

In theory, those choosing to not enter the labor force have the dual pressures of inflation and evaporating stimulus pools encouraging them to reattach. Unfortunately, that has not happened:

According to the employment numbers released Friday, the US has 5 million people more “not in the labor force” than before the pandemic. Employers must therefore tackle the delivery of more products and services with chronically lower labor inputs. This problem will not fully abate even if the economy slightly recesses. First quarter GDP declined 1.6% and Goldman slashed their 2nd quarter GDP estimate to .7% on Thursday. It is highly unusual to see a hot job market in a cool economy. Perhaps the numbers are distorted by seasonal adjustments, COVID cases, early retirements, the ”great resignation,” etc. Hard to know.

What we do know is that, taken to its extreme, if a country’s labor force shrinks faster than its GDP, unemployment rates can remain low indefinitely. See Japan. In sum, while the economy may slow or recess, given the present labor shortages, we don’t expect the typical surge higher in unemployment levels. Companies may seek relief in wages instead. Here we find some correlation with the softening economy as year-over-year wage increases have declined from 5.6% in March to 5.1% in June. That is encouraging from the Fed’s perspective, but still well above the 3% rates seen pre-pandemic.

Given the labor dynamics, most economists expect consumer resilience to provide a cushion for any upcoming recession. We agree. The official arbiter of recession is the National Bureau of Economic Research. Their methodology prioritizes changes in the unemployment rate and income metrics rather than simply sequential quarterly drops in GDP. Therefore, a tight labor market within a negative GDP environment could paradoxically lead to strong employment within a weak economy.

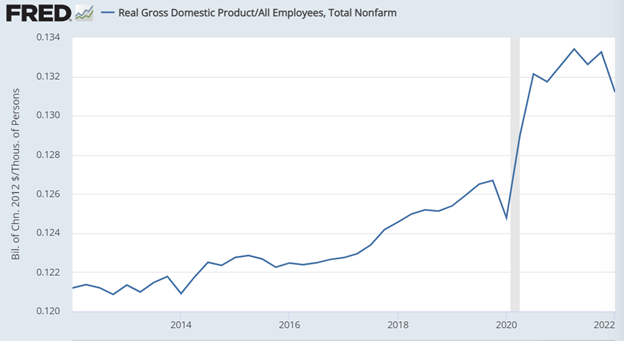

COVID economics continue to confound! The good news here for investors is consumer activity accounts for 70% of US GDP. Without a collapse in labor or wages, there shouldn’t be a collapse in corporate revenues…recession or not. Examine the chart below carefully. It’s the amount of GDP we are currently generating per worker. If you can have a “jobless recovery” like we had in the early 2000s, why can’t you have a “job-full recession” in the 2020s as this line normalizes?

Have a great Sunday!