The Full Story:

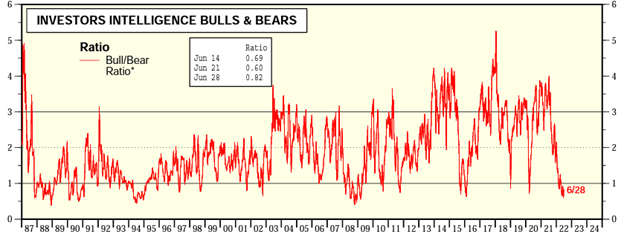

The first half of 2022 has finally ended. Within the first half, we experienced historic fiscal tightening as the COVID stimulus programs ended abruptly, we had high and persistent inflation which forced the Fed to tighten monetary policy to an historic degree, we had Russia invade Ukraine which cut off critical energy and food supplies to the world, we had China lock down its factories and major cities in compliance with its zero-COVID policy, and we had a Fed cheering on the onset of recession. This continuous drip of negative news has led to some of the most despondent sentiment readings on record. Consider the Bull (believe markets will go up)/ Bear (believe markets will go down) ratio for professional investors. On June 21st, 26% of all financial advisors polled counted themselves as bullish, while 44% counted themselves as bearish for a Bull/Bear ratio of .60. That is well below the Pandemic lows and right on par with the Great Recession lows.

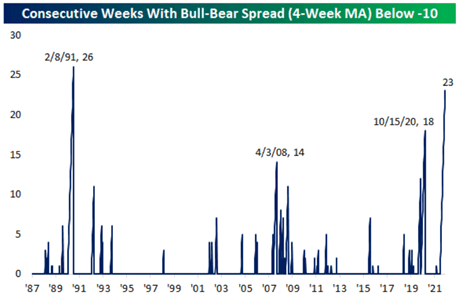

The non-professional investors feel even worse. On June 22nd, 18% of retail investors counted themselves as bullish, while 59% counted themselves as bearish for a Bull/Bear ratio of .3. The level of retail investor bearishness not only ranks 4th since inception, but the duration of their bearishness has also reached historic limits as well:

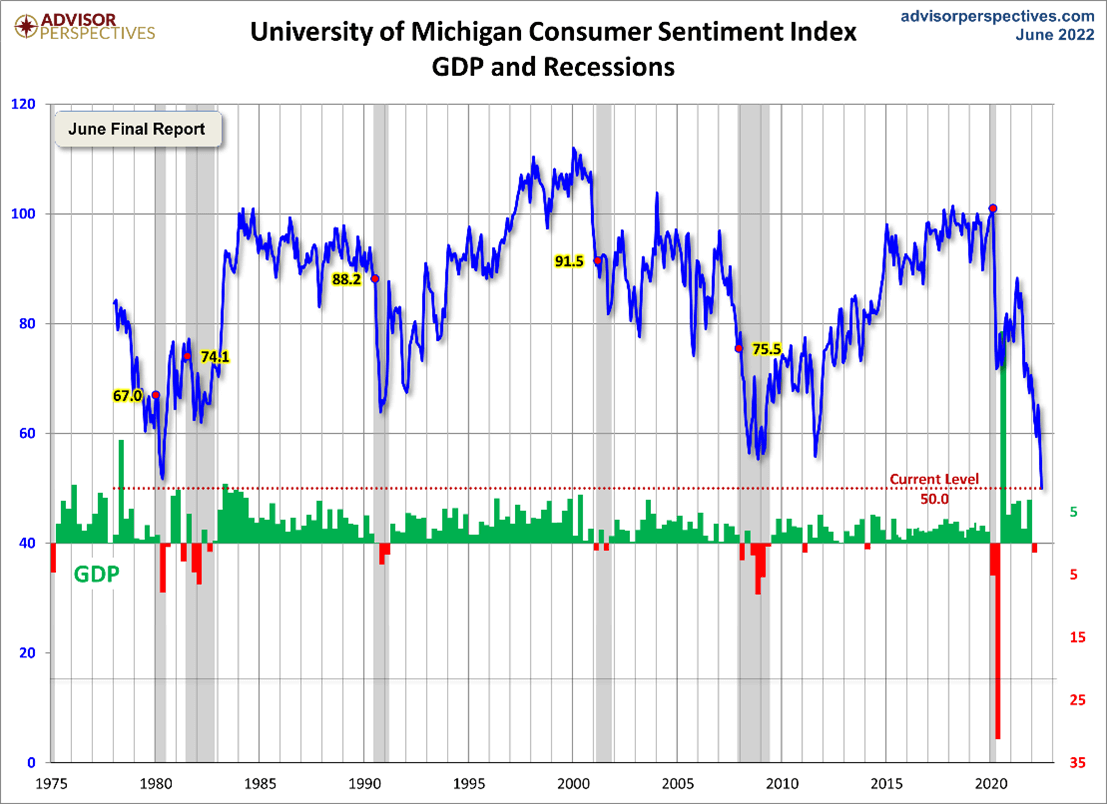

Various consumer sentiment indices mirror this historic pessimism. In fact, the Michigan Consumer Sentiment Index just hit an all-time low, nearly 50% below its historic average and at a level previously associated with recession depths:

In an effort not to over-chart, I will save you from the Conference Board’s Consumer Confidence Survey, the NFIB Small Business Survey, and various business confidence indices. They all agree. This is the worst of times.

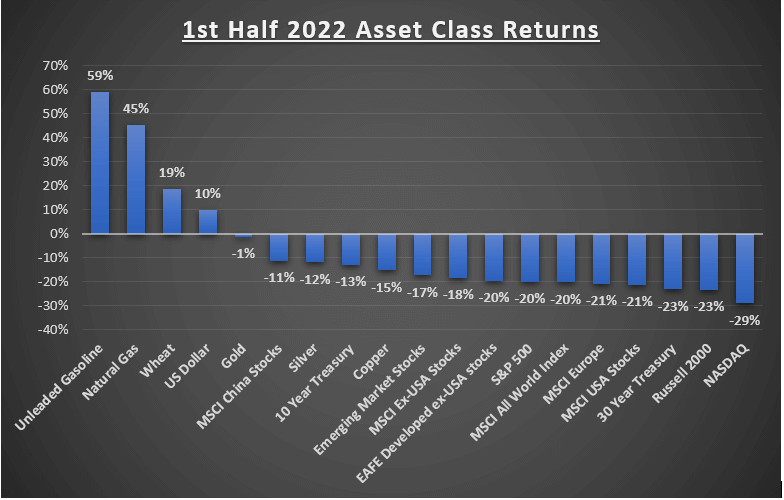

First-half investor returns across every asset class reflect the overwhelming depression in business, consumer, and investor confidence… unless your portfolio consisted entirely of gasoline, natural gas, and wheat:

To punctuate the end of the first half of 2022, headlines read:

- Wall Street Journal: “Markets Post Worst First Half of a Year in Decades”

- CNBC: “S&P 500 Posts Worst First Half since 1970

- CNN: “Tech stocks are having their worst year ever”

- New York Times: “After Stock Markets Worst Start in 50 years, Some See More Pain Ahead”

Maybe it truly is the worst of times.

Maybe Not

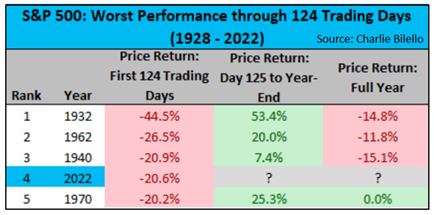

Given the current array of information, I really have nothing positive to say. Inflation remains rampant worldwide. Economic statistics keep declining faster than economists’ expectations. Profit margins for companies keep eroding, and analysts will soon mark down earnings estimates. President Biden restarted the Cold War with Russia with shouts of NATO rearmament. Monkeypox cases are growing. Polio has been discovered in the UK. COVID cases are back on the rise. Inflation. Invasion. Recession. Infection. Oh my! And yet, perhaps having nothing positive to say IS the most positive thing to say. While the headlines read “worst first half in decades,” the second half returns during analogous periods may surprise you:

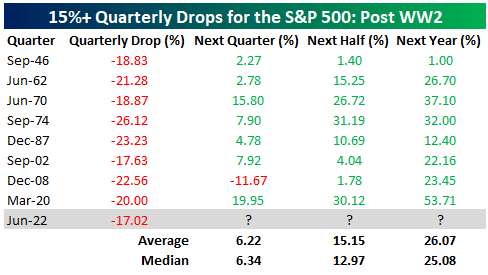

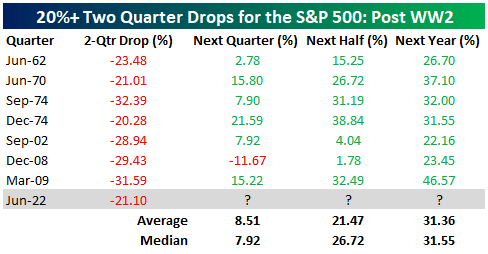

Fifty years ago in 1970, as reported, the S&P 500 declined 20.2% over the first half of the year. It then rose 25.5% over the second half of the year. In fact, averaging the 2nd half of the year advances in each of these periods of maximum pessimism produces investor returns of 26.5%. Those who took statistics will no doubt challenge my conclusion based upon the sample space being too small. Fair enough. Here are some larger data sets generated by Bespoke Investment Group that yield similar surprises:

In each of these data sets, after jarring declines during despondent periods, returns have been robust over the next half, and the next year… IN EVERY OCCURRENCE.

We all learned that the wild optimists who proclaimed “this time is different” during the dot-com bubble, the housing bubble, and the crypto bubble turned out to be wrong. Why do the same rules not apply to the wild pessimists proclaiming, “this time is different” today? I am not suggesting stocks cannot go lower from here — in fact, they probably will. What I am suggesting is that whenever pessimism reaches extremes like it has today, historically, the patient and the brave get paid.

Have a great Sunday and enjoy the long weekend!