The Full Story:

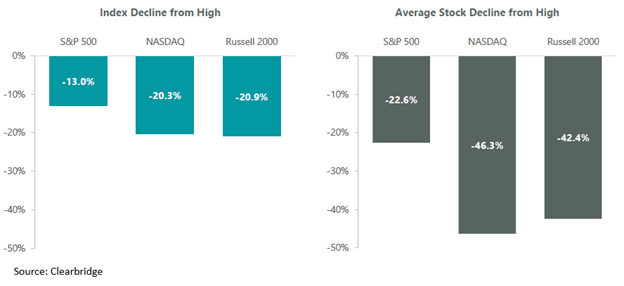

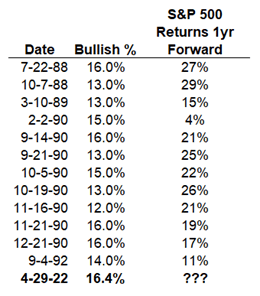

Yesterday, I presented to a boardroom full of business leaders and asked them to raise their hands if they believed the market would be higher six months from now. One of the 20 members raised their hand. That is a 5% bullish reading. Each week, the Association of Individual Investors conducts a nationwide survey and asks the same question. As per the last reading, 16.4% of respondents registered as bullish. The AAII has asked this question every week for the last 35 years. That is 1,820 weeks. Bullish sentiment registered below 16.4% in only 12 of those weeks. The last time investors were this pessimistic was the week ended 12/21/1990. In other words, investors are less optimistic today than they were during the bursting of the tech bubble, the attacks on 9/11, the Great Financial Crisis, and the COVID pandemic. This 16.4% reading may seem overblown with the S&P 500 down an historically reasonable 13% on the year, but for many investors, the damage has been far worse. As seen in the chart below, from each respective indices’ highs to their respective lows, the average stock declines have far outpaced their headline losses (remember that these indexes are size-weighted, not equal-weighted):

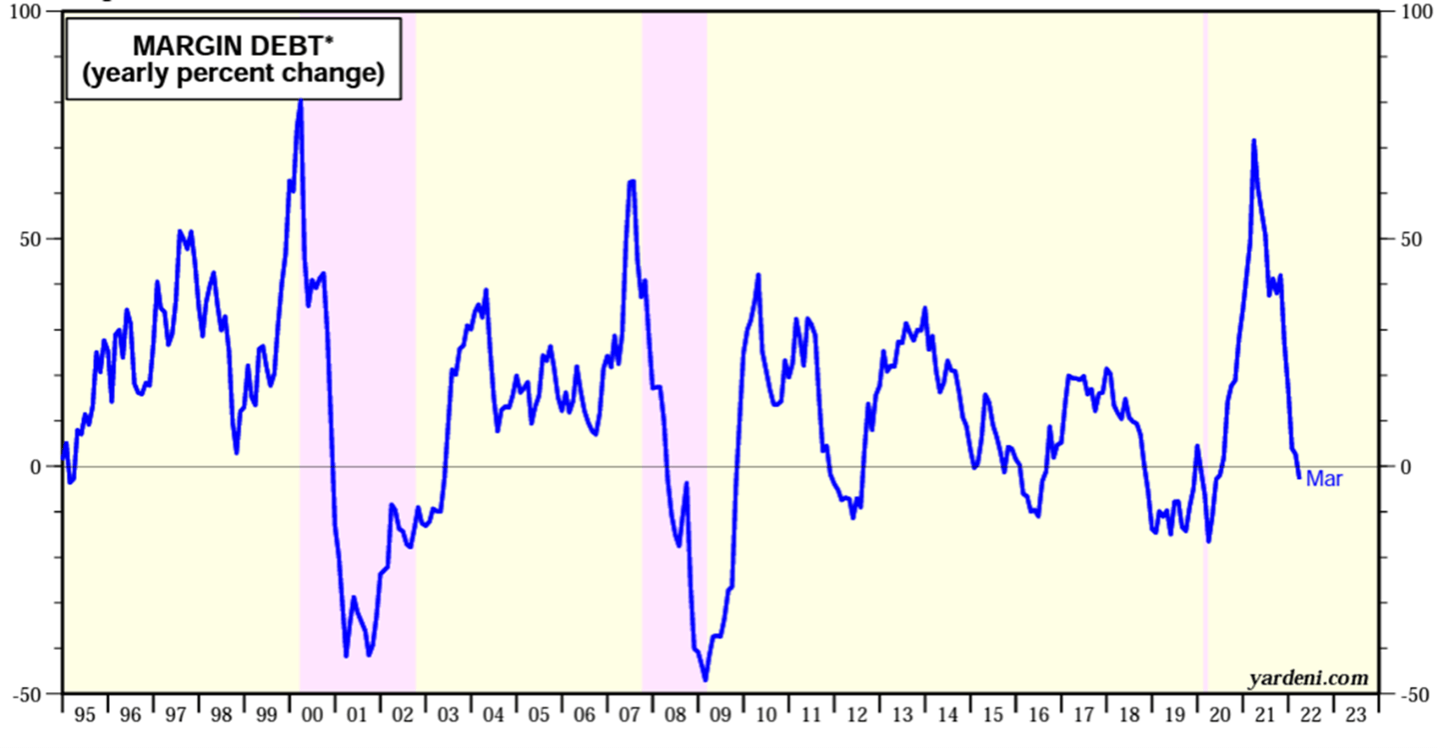

Given the persistence of tech’s outperformance, many investors over-allocated to technology stocks and have taken severe punishment. Many also found their way into the crypto-complex only to incur losses of 32% on Bitcoin over the past year and 33% on Ethereum year-to-date. Even bond investors have taken the pain with 10% losses in the aggregate bond index and even 5% in “inflation protected Treasuries”. Only commodity investments have rewarded investors this year… but how many of you really own natural gas? No wonder investors seem so down! This pessimism has begun expressing itself within investor cash levels and margin volumes. Note the collapse in margin debt usage year to date:

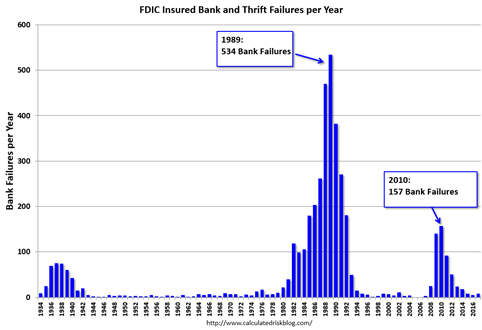

We have only seen these collapses coincident with recessions over the past 30 years, and while first-quarter GDP tipped negative due to the Omicron pause, the leading economic indicators signal continued expansion. However, the violent forward guidance from the Fed has convinced many that the Fed will deliberately tank the economy to stamp out inflation. Powell even whimsically referenced Paul Volker in his last testimony. For those who have forgotten, Volker raised the Fed funds rate 10% in 1980 and both price inflation and asset inflation collapsed. Farmland prices declined 34% between 1982 and 1987, setting off a major string of bank failures that dwarfed those seen during the Great Financial Crisis:

The Volker recession bankrupted thousands of businesses, forced unemployment up to post-Depression highs, led to twenty-two months of negative growth, and hollowed out the Rust Belt. As Volker critic Tim Barker reported: “In Akron, the commercial blood bank reduced the prices it would pay by 20 percent due to the glut of laid-off tire workers lining up to bleed.” So, in addition to convincing traders that the Fed will raise rates more than 3% over the next twelve months while shrinking their balance sheet at thrice the pace of their last quantitative tightening campaign, they have also praised Volker’s recessionary schadenfreude as an acceptable method of inflation dousing. Oh, and I haven’t even mentioned reports of global food shortages and the threat of nuclear war. What a parade of horribles!

What Could Possibly Go Right?

China:

Many have reported that the lockdowns in China resemble the lockdowns in the USA circa March of 2020. If that’s the case, then China should soon deploy massive stimulus followed by loosened restrictions. On point, Xi Jinping announced several measures this week to support his 5.5% GDP growth target for the year. These included mailbox money for consumers, a commitment to fund infrastructure programs, a reprieve for businesses paying unemployment insurance premiums, starter payments for entrepreneurs, etc. The monetary value of these proclamations remains unknown, but a highly subsidized pursuit of a 5.5%+ growth rate certainly cheered Chinese investors, sparking a 4% rally in Hong Kong overnight and an 8% rally in KWEB, a proxy for Chinese internet stocks. Remember, China provided the stimulus that saved the world from depression in 2009, not the United States. In 2020, the United States provided the stimulus salvation. It is now 2022 and due to their self-imposed economic restrictions injuring us all, it’s China’s serve.

Fed:

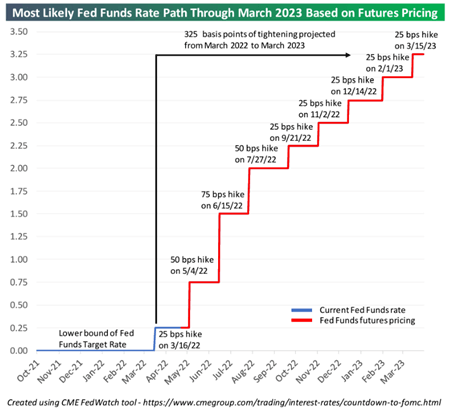

The Fed will hold another FOMC meeting next week. They have committed to raising rates by .50%, but the forward guidance will gather more attention. Right now, the market expects continued tough talk and a relentless rise in rates as chronicled below:

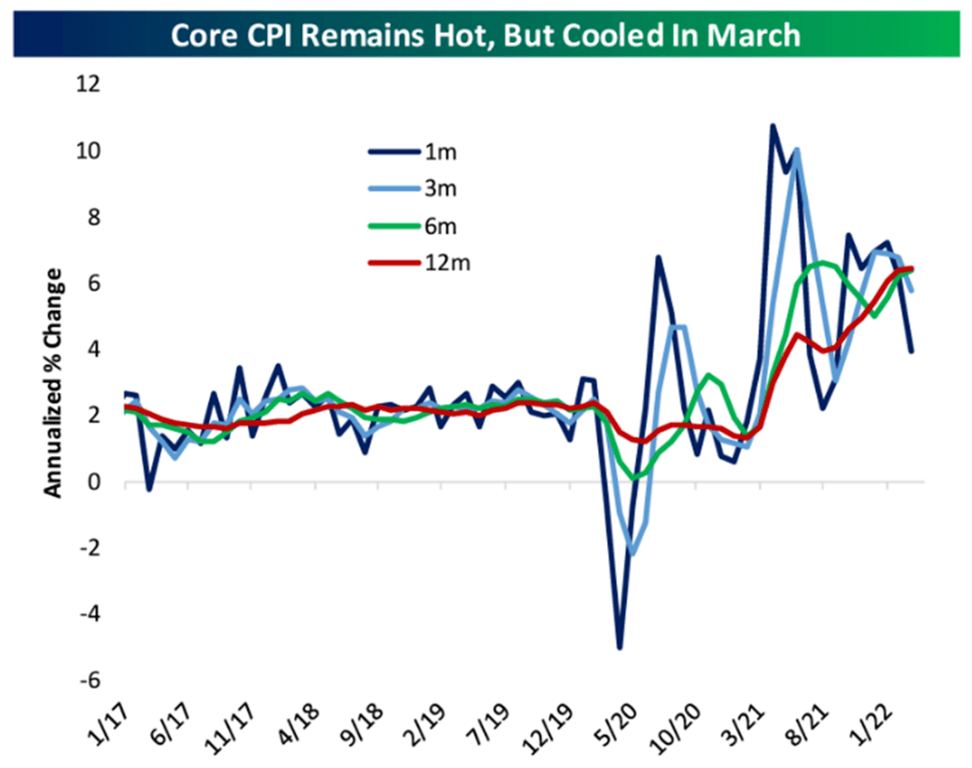

Any dovish language pivot at all would reassure investors that Powell’s goal is not to mindlessly reprise the “Volker Shock.” And while inflation measures remain elevated, they may have peaked. Recent results show signs of cooling when comparing inflation readings month-over-month:

Historically, the market overestimates the slope and scope of Fed interest rate hike cycles. With an economy that grows normally around 2%, a 3. 5% terminal Fed Funds rate seems unrealistic to us. At some point, futures markets may start removing rather than adding expected rate hikes. That would seriously cheer investors.

Economic Growth:

US GDP posted a negative 1. 4% number in Q1 due to inflation, Omicron, and Russian distortions. Companies stockpiled inventories which lead to a surge in imports, and post-stimulus government spending collapsed. Inside the report, consumer spending grew 2.7%, a more accurate measure of economic activity. Also, GDP unadjusted for inflation grew 6.5%. Remember, as inflation recedes, the inflation tax on “real” GDP recedes as well. For the second quarter, the blue-chip economists project GDP growth of 3%. The Fed itself projects 2.8% GDP growth for 2022 overall. While the cocktail consensus has adopted a recession view, the economists have not.

Putin:

Who knows?

What’s Possible?

I will conclude with this. Many of our long-term readers may recognize that I call out AAII Bullish readings below 20 whenever I see them. The last time I drew attention to them was in our 2/24 weekly, the week of the Ukrainian invasion, when I stated:

“

The best buying opportunity comes not when people are euphoric, but when they are despondent.” The S&P 500 rallied 3% that next week, 12% over the next month, and still hasn’t breached the 2/24 low. I am not back-patting (that invites humbling), just pointing out that extreme pessimism is investable. In fact, here are the 12 episodes over the last 35 years when the weekly AAII bullish reading read less than today, paired with the subsequent 12-month returns:

History might be different this time… but what if it’s not?

Have a great Sunday!