The Full Story:

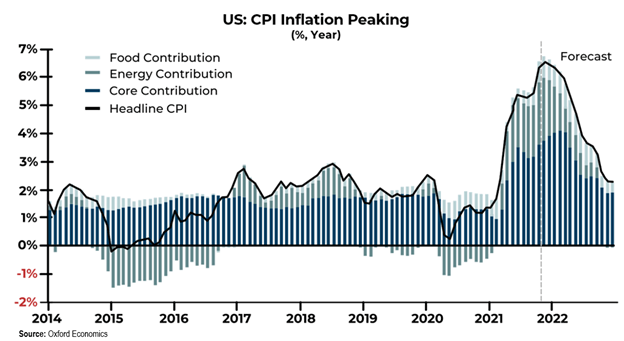

As we ski into year-end, investors seem rather deflated about inflation. October’s 6.2% inflation print certainly didn’t help. Furthermore, the raging debates in Washington over deploying additional multi-trillions in fiscal stimulus only amplify concerns. Up to this point, we have chosen to side with the “transitory” inflationists, viewing the current surge in inflation as a consequence of policy distortions amidst a broader undercurrent of disinflationary trends. But forecasts often fail, and within this business, only the paranoid survive. So, this week, we will dig into our transitory orientation and reveal whether we expect inflation to be higher or lower in 2022.

Demanding More Supply!

On November 10th, the Bureau of Labor Statistics reported that U.S. consumer price inflation (CPI) rose 6.2% over the last twelve months. We haven’t seen an inflation reading that high since 1990. We also haven’t seen inflation sustained at that level since 1982. This number made for dramatic headlines, but let’s keep reading beneath the fold.

Energy contributed the highest level of inflation by far among the underlying components. Energy inflation overall (petroleum distillates + natural gas + electricity) rose 30% versus one year ago. Within energy, gasoline and fuel oil prices rose 49.6% and 59%, respectively. While it’s currently no fun to fill up the family truckster, this shouldn’t be surprising. The initial quarantine mandates created a hard stop across the economy and virtually eliminated demand for oil. Shortly thereafter, WTI crude oil prices actually fell below zero! This led to a capping of wells and a cessation of oil production.

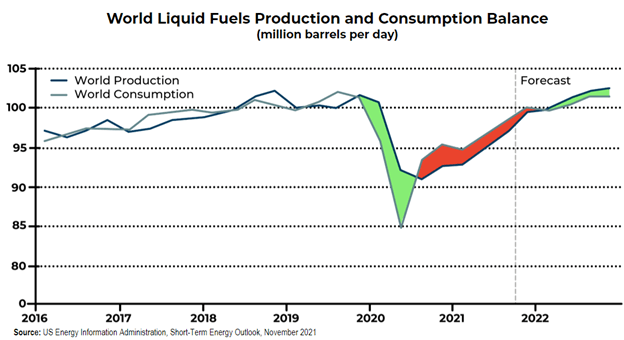

In response, governments worldwide deployed the largest amount of monetary and fiscal stimulus in human history. Demand returned at an historic pace, revealing major shortages in petroleum supplies. Lower supply mixed with higher demand axiomatically combusts into higher prices. The chart below chronicles the path of oil supply and demand over the past five years, and forecasts where they are likely headed:

I have highlighted in green the timeframe where the COVID pandemic collapsed demand faster than supply, a condition that led to much lower oil prices. I have highlighted in red our current timeframe where STIMULUS has caused demand to surge ahead of supply, a condition that has led to much higher oil prices. Post-2021, the U.S. Energy Information Administration (EIA) forecasts that supply levels will increase and recalibrate production and consumption. This search for equilibrium should lead to lower prices.

For illustration, the U.S. produced 12.7 million barrels of oil per day in 2019. In 2020, the U.S. produced just 10.8 million barrels per day. Currently, the U.S. produces 11.5 million barrels per day, which is well off the production lows of 2020 but still 1.2 million barrels per day short of 2019’s production. Not only does the EIA forecast a continued rise in US production, but political pressures have inspired a recent release of 3 million barrels from the Strategic Petroleum Reserve (SPR). (Sadly, I’m not the President. But if I was, and my poll numbers were dropping due to inflation mismanagement claims, I might feel compelled to release even more oil from the SPR as a way to reduce headline CPI. I’m not saying that I would… but I might consider it!)

Taken together, most recent oil commentary has suggested potential oversupply in 2022 rather than the undersupply that we experienced in 2021. This has already begun to drive prices lower. December 2021 oil delivery trades at $76 per barrel, down from $85 per barrel less than a month ago. December 2022 oil delivery trades at $69 per barrel, which is another 10% lower. Therefore, we may have already seen peak oil inflation for this cycle.

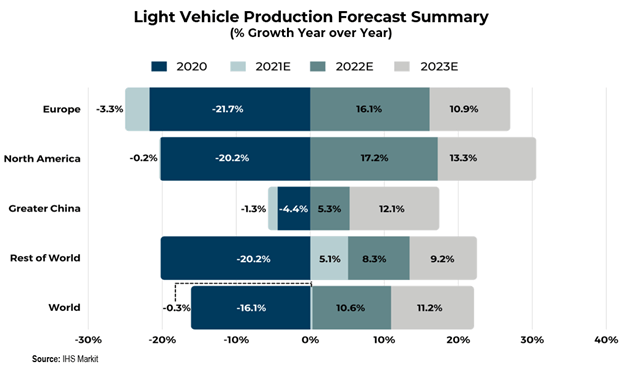

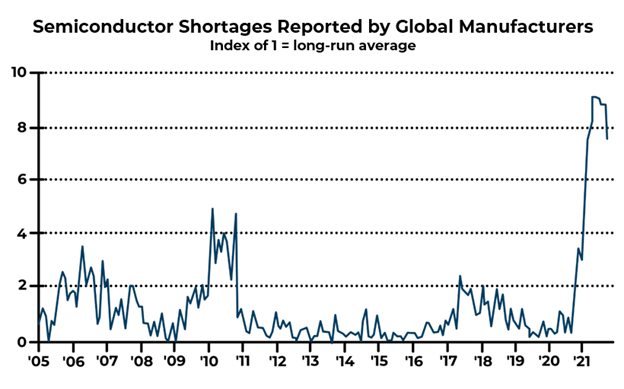

The global shortage of semiconductors has also roiled inflation numbers. Auto producers have borne the brunt of the chip shortage burden, which left them unable to produce enough vehicles to meet highly stimulated vehicle demand and driving prices higher. Over the last 12 months, new car prices rose 10% while used car prices rose 26.4%. Fortunately, semiconductor production numbers are increasing, and auto manufacturers have retooled some designs to require fewer chips. For 2020, the total global volume of vehicle production declined 16.1%. For 2021, it declined an additional 0.3%. But, forecasts for 2022 show production volumes growing 10% to 15% with similar expansion in 2023.

Of course, these are only forecasts, but both GM and Ford have recently maintained production outlooks, which is a good indicator of easing supply pressures. In fact, according to recent surveys, manufacturers overall are citing some semiconductor shortage relief:

Nonetheless, we do not expect the shortages to clear quickly, as adding semiconductor production capacity takes time. However, peak semiconductor shortage may have passed, and peak vehicle inflation may have passed with it.

Outside of energy, commodities, and vehicles, inflation levels are elevated, but not unwieldy. Services like shelter, medical care, and transportation account for 58% of the CPI calculation and have risen a more pedestrian 3.2% year-over-year in aggregate. Therefore, in our view, increased oil, commodities, and vehicle production should help cool inflation down meaningfully in 2022 and leaving the October 6.2% CPI print as the peak inflation print for this cycle!

Have a great Sunday!

David S. Waddell

CEO, Chief Investment Strategist